Qualified Investor Leads: How to Get High Quality Leads

It is surprising how many new entrepreneurs miss out on qualified investor leads.

Most newly-launched brands put off looking for an investor. But finding high quality leads for investors could propel your business.

Be sure to utilise an agency that can help you diligently pick out a qualified investor that is likely to invest in and fit your business.

Contents

Understanding Qualified Investor Leads

Qualified investor leads are individuals with capital seeking an opportunity to invest in a new business, they’re qualified because they have shown interest in the same niche or industry that your brand is in.

Getting qualified investor leads involves significant effort and strategic planning by agencies. This investment pays off by saving you time and money, as it connects you with potential investors who are likely to engage.

Finding the right investor can be time-consuming, and the process itself can often be lengthy.

When seeking qualified investor leads, it’s crucial to find individuals whose profiles align with your business needs and who are financially prepared to take action.

Find out why using a virtual assistant is important for helping you generate leads and bring in new business.

Pay Nothing on Qualified Investor Leads

Generally, you pick your agency or platform and pay for the leads. It’s down to your due-diligence to ensure that your leads will be high quality.

But that’s where we differ – here at FatRank we are unique, offering risk-free leads. Get exclusive leads and only pay once they convert.

Our rare pay-on-conversion means that you only pay once the lead converts. It lessens the worry about upfront costs and the quality of leads; we have confidence in our work to increase your ROI, putting our money where our mouth is.

Why are Qualified Investor Leads Important?

Qualified leads are important when finding investment, otherwise, you’re sure to waste your time searching among the wrong capital investors.

Here are some of the benefits of gaining qualified investor leads:

Targeted Engagement

Qualified leads allow for more personalised and effective marketing strategies. By understanding the specific interests and financial capabilities of each lead, businesses can tailor their pitches, increasing the likelihood of investment.

Targeted leads are gathered through outbound lead generation, this can be done through PPC, SEO or other strategies.

Higher Conversion Rates

With pre-qualified leads, the conversion process is typically more efficient. These investors are already interested and financially ready, which significantly reduces the effort required to convert general interest into actual investment.

Getting high-conversion rates comes down to the quality and relevancy of your leads.

Resource Efficiency

Focusing on qualified leads helps businesses allocate their resources more effectively. Time and effort can be spent engaging with individuals who are more likely to result in successful transactions, rather than sifting through less promising prospects.

Risk Reduction

Engaging with qualified leads reduces the risk of encountering unfruitful investment discussions. Each lead’s financial readiness and investment history are pre-assessed, aligning opportunities with the right investor profiles.

Why Are Investors Important for New Businesses?

Investors provide essential capital to new businesses, enabling them to fund operations, invest in technology, and hire staff. This financial support is crucial for covering the upfront costs that come with launching a business.

Additionally, investors bring valuable experience and networks, offering guidance and access to potential partners or additional resources that can accelerate business growth. They also contribute to the credibility of a new business, making it easier to attract further investment and customers.

Processes for Finding Qualified Investors

When it comes to finding investors, you want them to be qualified. This means going through a number of processes, including vetting them and ensuring they have the funds.

Checking Funds

There are different processes that agencies can put potential investors through to ensure they have proof of funds and are legit investors.

The last thing a new business wants, is to deal with a time-waster. This can be damaging in the start of a launch, when you could be potentially speaking to somebody who does want to invest.

It is sometimes more difficult to find an investor yourself, but when using an agency or our help at Fat Rank you could get leads from qualified investors.

Vetting Their Reputation

All leads should be vetted, this means that you qualify them first. It can mean going through processes such as calls, interviews and other stages.

An agency with qualified leads will do this, so be sure that you are dealing with a legit and interested investor.

Aligning with Your Business

When finding an investor, you need to make sure it aligns with your business and your needs. Are they aware of the deal, how hands-on are they, and are they interested in the niche?

Find someone who aligns with what you need in your business.

Strategies for Finding Qualified Investors

It’s hard to know where to start when looking for qualified investors, but there are strategies that make it easier.

Using SEO to Attract Investors

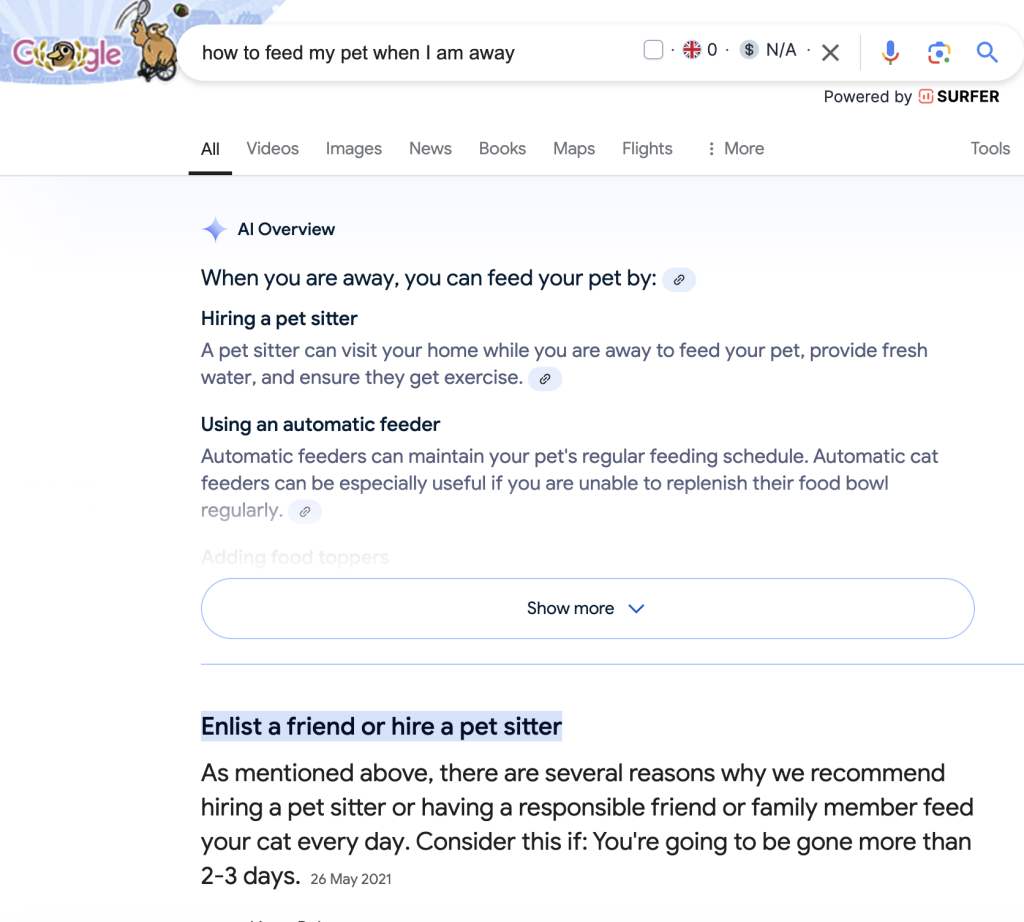

Search Engine Optimisation (SEO) enhances the visibility of your investment opportunities to qualified investors who are searching for potential ventures online.

Ranking higher on search engines can get you seen, and by targeting specific queries, you can find your target investor. Find qualified investors using SEO techniques or by using an agency that already has expertise in ranking on Google.

Leveraging PPC Campaigns for Immediate Visibility

Pay-Per-Click (PPC) advertising offers immediate exposure to your investment propositions.

Tailoring PPC campaigns to target specific demographics based on financial capability and investment interests can drive highly qualified leads directly to your site, increasing the chances of investment.

Engaging Through Social Media Platforms

Social media platforms like LinkedIn, Twitter, and Facebook can be powerful tools for connecting with potential investors.

Creating engaging content that highlights investment successes, sharing insights into the market, and actively participating in investment-related discussions can help establish credibility and attract investors who are aligned with your business goals.

Networking at Industry Events

Attending industry events, seminars, and conferences where potential investors might gather is an invaluable strategy.

These events provide opportunities for face-to-face interactions, allowing you to personally convey your business’s value and investment potential, building relationships that could lead to future investments.

Developing Content Marketing Strategies

Content marketing can attract qualified investors by providing them with valuable information related to their investment interests.

By producing high-quality blogs, whitepapers, and case studies that resonate with potential investors, you establish your business as a knowledgeable and trustworthy entity, making it more attractive to invest in.

Investor Databases and Platforms

There are numerous databases and platforms dedicated to connecting investors with opportunities.

By registering your business with these platforms and actively engaging with their communities, you can directly reach out to individuals who are already interested in investing.

Each of these strategies offers a unique avenue to connect with qualified investors, allowing businesses to expand their reach and improve their chances of securing the necessary capital for growth.

FAQs

Why should you qualify leads?

Qualifying investor leads is crucial because it ensures that potential investors meet the necessary financial criteria to participate in investment opportunities, protecting both the investors and the firm from regulatory issues and financial risks.

By qualifying investor leads, firms can target individuals who have the financial capability and interest to invest, leading to higher conversion rates and more efficient use of marketing resources. This process helps maintain compliance with regulatory standards, ensuring that only eligible investors participate in specific investment opportunities.

Other Articles You May Like

Find other related articles on lead generation and things you should know:

- 10 Ways to Generate Sales Leads Without Cold Calling

- Accountants Lead Generation

- Addiction Rehab Treatment Lead Generation

- Annuity Lead Generation

- Architects Lead Generation

- Attorney Lead Generation

- B2B vs B2C Lead Generation

- Bark.com Review

- Boiler Lead Generation

- Building Lead Generation

- Carpet Cleaning Lead Generation

- Checkatrade Review

- Chiropractic Lead Generation

- Cleaning Lead Generation

- Concrete Lead Generation

- Conservatory Lead Generation

- Credit Repair Lead Generation

- Cyber Security Lead Generation

- Damp Proofing Lead Generation

- Debt Lead Generation

- Decorator Lead Generation

- Dentist Lead Generation

- Digital Marketing Strategies for Lead Generation

- Double Glazing Lead Generation

- Driveway Lead Generation

- Electrician Lead Generation

- Equity Release Lead Generation

- Excavation Contractor Lead Generation

- Fencing Lead Generation

- Financial Advisor Lead Generation

- Fintech Lead Generation: 5 Strategies for Fintech Companies

- Garage Door Lead Generation

- Heat Pump Lead Generation

- Heating Lead Generation

- Home Improvement Lead Generation

- How to Choose the Right Lead Generation Client

- How to Generate More Leads

- HVAC Lead Generation

- Importance Of Exclusive Leads

- Importance Of Leads That Convert Into Profit

- In-Market Lead Generation vs Out-Of-Market Demand Generation

- Inbound Lead Generation Agency

- Insulation Lead Generation for Cavity Wall or Loft Insulations

- Is Lead Generation Worth it?

- Is Yellow Pages Business Advertising Value For Money?

- IT Services Lead Generation

- Joiner Lead Generation

- Landscaping Lead Generation

- Lawyers Lead Generation

- Lead Generation for Recruitment Agencies

- Lead Generation Quotes to Inspire You

- Lead Generation Testimonials

- Lead Nurturing Strategies

- Lead Simplify Review

- Leads First: Everything Flows Downstream After Lead Generation

- Life Insurance Lead Generation

- Loans Lead Generation

- Locksmith Lead Generation

- Loft Conversion Lead Generation

- Mortgage Lead Generation

- Mould Remediation Lead Generation

- My Builder Review

- Outbound Lead Generation Agency

- Outsourced b2b Lead Generation

- Painting Contractor Lead Generation

- Pay Per Lead Generation

- Personal Trainer Lead Generation

- Pest Control Lead Generation

- Photographer Lead Generation

- Plastering Lead Generation

- Plastic Surgery Lead Generation

- Plumbing Lead Generation

- PPC Lead Generation

- Pressure Washing Lead Generation

- Qualified Investor Leads: How to Get High Quality Leads

- Questions You Should Ask Lead Generation Companies

- Real Estate Lead Generation

- Reasons to Decline Lead Generation Requests

- Recruitment Lead Generation

- Rendering Lead Generation

- Responding to Leads

- Roofing Lead Generation

- SaaS Lead Generation

- Scaffolding Lead Generation

- SEO Lead Generation

- Solar Panel Lead Generation

- Stairlift lead generation

- Suspended Ceiling Lead Generation

- Tradesman Websites

- Tree Service Lead Generation

- TrustATrader Review

- Twitter Ads Lead Generation | Buy Twitter Advertising Leads

- Videographer Lead Generation

- Virtual Assistant Lead Generation

- Water Damage Lead Generation

- Web Design Lead Generation

- What is a Lead

- What Is Lead Management

- What Is The Impact Of Lead Response Time

- What Is The Importance Of Lead Quality

- Why is Lead Attribution Important?

- Why Real-Time Leads Could Boost Your Sales

- Zero Risk Lead Generation Service

About FatRank

Our aim to explain and educate from a basic level to an advanced on SEO and Social Media Marketing.